India's real estate sector is a dynamic powerhouse, significantly contributing to the nation's economy. As we look towards 2025, the trajectory of this vital industry is not solely dictated by market forces but is substantially influenced by a robust framework of government policies, stringent RERA regulations, and attractive tax benefits. These three pillars are collectively powering unprecedented growth, fostering transparency, and making real estate an increasingly appealing investment avenue across the country, particularly in high-growth corridors like Developed Noida.

The Indian government has, over the past few years, demonstrated a clear commitment to boosting the real estate sector through a series of forward-thinking policies. These initiatives are designed to stimulate demand, streamline approvals, and attract both domestic and foreign investment.

One of the most impactful policy drives has been the emphasis on affordable housing. Schemes like the Pradhan Mantri Awas Yojana (PMAY) have provided significant subsidies and incentives, making home ownership accessible to a wider demographic. While this directly addresses social objectives, it also creates a massive demand base for housing, encouraging top builders to undertake large-scale projects and contribute to the overall growing real estate market. The ripple effect extends to developing sectors, where new townships and residential complexes are emerging to meet this demand.

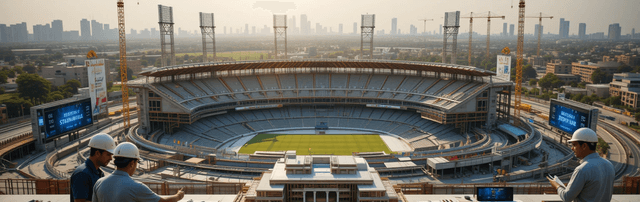

Furthermore, infrastructure development remains a top priority for the government. Massive investments in roads, railways, ports, and airports are directly influencing real estate values. A prime example of this is the Jewar Airport (Noida International Airport). This mega-project, spearheaded by government vision, is single-handedly transforming the entire region around Noida and the Yamuna Expressway. The promise of world-class connectivity and economic activity around the airport is a major magnet for investment, leading to a significant hiking price in land and property values in the surrounding developing sectors. Such strategic infrastructure pushes are powerful drivers for real estate as an investment.

Policies promoting ease of doing business have also played a crucial role. Efforts to digitize land records, simplify approval processes, and reduce bureaucratic hurdles have made it easier for top builders to operate, expediting project completion and delivery. This efficiency, in turn, benefits buyers and investors by offering more choices and quicker possession, thereby strengthening the real estate market as an investment.

Before the implementation of the Real Estate (Regulation and Development) Act, 2016 (RERA), the Indian real estate sector was often plagued by issues of delays, lack of accountability, and opaque transactions. RERA has emerged as a game-changer, fundamentally reshaping the industry by instilling transparency, fairness, and accountability.

Enhanced Consumer Protection: RERA mandates that all real estate projects above a certain size must be registered with the respective state's RERA authority. This registration requires developers to disclose detailed project information, including layouts, specifications, timelines, and payment schedules. This level of transparency empowers buyers with crucial information, reducing the chances of misrepresentation and fraud. For an investment in property, this assurance is invaluable.

Accountability and Timely Delivery: One of RERA's most significant provisions is the requirement for developers to deposit 70% of the funds collected from buyers into a separate escrow account, to be used solely for the construction of that specific project. This prevents diversion of funds and ensures that projects are completed on time. Penalties for project delays are also clearly defined, holding top builders accountable. This newfound reliability makes luxury apartments and other residential projects more attractive for investment, particularly in fast-growing regions like Developed Noida where large-scale projects are common.

Dispute Resolution Mechanism: RERA establishes a fast-track dispute resolution mechanism, offering buyers a quicker and more effective recourse in case of grievances against developers. This legal framework has significantly boosted buyer confidence, which is vital for sustaining real estate growth. Investors considering real estate as an investment can proceed with greater assurance, knowing their interests are protected.

The positive impact of RERA is particularly visible in mature and developing markets alike. In regions like Developed Noida, where the growing real estate market attracts numerous top builders constructing high-value luxury apartments, RERA acts as a vital safeguard, ensuring ethical practices and fostering a trustworthy environment for property transactions. This regulatory oversight contributes directly to the stability and long-term appreciation of real estate as an investment.

Government policies extend beyond direct development, utilizing the tax framework to encourage both homeownership and real estate investment. These tax benefits provide significant financial relief and make property acquisition more attractive.

Deductions on Home Loan Interest: One of the most substantial benefits for homeowners is the deduction on interest paid on home loans. Under Section 24(b) of the Income Tax Act, taxpayers can claim a deduction of up to ₹2 lakh on interest paid on a home loan for a self-occupied property. For rented properties, there's no upper limit on the interest deduction, although losses from house property are capped for set-off against other income. This significantly reduces the effective cost of EMI, making real estate as an investment more affordable.

Deductions on Principal Repayment: Under Section 80C, principal repayment of a home loan qualifies for a deduction up to ₹1.5 lakh per financial year. This, combined with other eligible investments under 80C, provides a substantial tax-saving opportunity for individuals investing in property.

Tax Exemption on Rental Income: While rental income is taxable under "Income from House Property," various deductions are available, including a standard deduction of 30% of the net annual value, property tax paid, and interest on home loans. These provisions make owning a rental property a lucrative investment strategy.

Capital Gains Benefits: The tax treatment of capital gains from the sale of property also offers incentives. Long-term capital gains (LTCG) from real estate held for more than 24 months are taxed at a concessional rate of 20% with indexation benefits. Furthermore, re-investment of LTCG into another residential property can offer exemptions under Section 54, encouraging further real estate investment.

These tax benefits collectively lower the overall cost of acquiring and owning property, thereby acting as a significant catalyst for demand. They make the prospect of investing in luxury apartments or plots in developing sectors even more appealing, especially in areas like Developed Noida where the hiking price of properties is a strong indicator of future appreciation.

As we head into 2025, the combined force of these government policies, RERA regulations, and tax benefits creates a powerful, positive feedback loop for India's real estate sector. The government's push for infrastructure, exemplified by the Jewar Airport and the Yamuna Expressway, creates new economic hubs and demand. RERA ensures that this growth is transparent and consumer-centric, building trust and encouraging more buyers to enter the market. Simultaneously, tax benefits make homeownership and investment more financially viable.

This synergy is particularly pronounced in high-potential regions. Developed Noida, with its strategic location, planned development, and attraction of top builders constructing luxury apartments and integrated townships, stands as a prime example. The growing real estate here is not just organic; it's a meticulously cultivated environment where policy supports, regulatory safeguards, and financial incentives align perfectly. The continuous hiking price in these areas reflects the market's confidence in this robust framework.

For anyone considering real estate as an investment in 2025, understanding these foundational elements is crucial. They are not merely background factors but active forces that are shaping the market, creating a more stable, transparent, and profitable landscape for buyers, developers, and investors alike. The outlook for India's real estate, underpinned by these powerful drivers, remains exceptionally strong.

The residential Real Estate Buyer...Read more

Kalpataru Vista is a new premium...Read more

Change your lifestyle, change Your...Read more

Jewar Airport is an Noida International...Read more

Noida has become one of...Read more

Gurgaon‘s Golf Course...Read more

There will soon be a...Read more

Connecting the corners of the...Read more

It's that time of the...Read more

Metaverse real estate is one...Read more

Are you looking for ways...Read more

Budget 2023 - The projects...Read more

The process of buying and...Read more

The Delhi–Mumbai Expressway is a 1,386 km...Read more

The commercial real estate sector...Read more

The Uttar Pradesh cricket association...Read more

Nestled in the lush greenery...Read more

The...Read more

Introduction

The Read more

Noida has rapidly become one...Read more

Noida’s real estate market has...Read more

Noida is no...Read more

The Read more

Noida...Read more

The allure of real estate...Read more

Find your dream property with trust, quality, and the

perfect match for your needs.

Office Address

303, Tower 4, Assotech Business Cresterra,

Sector 135 Noida, Uttar Pradesh, India 201305

Contact

+91 9582-211-311

Email Us

info@propcasa.com