The Yamuna Expressway corridor has quietly transformed from a long, fast highway into one of North India’s most compelling real-estate growth belts. Once thought of as peripheral land linking Greater Noida to Agra, the corridor is now being reshaped by infrastructure projects, government land-use planning by YEIDA, industry-scale logistics investments, and a steady flow of residential and township launches. For investors looking for a mix of capital appreciation and long-term rental demand, the Yamuna Expressway offers a rare combination: comparatively affordable entry prices today, paired with large infrastructure catalysts that are likely to unlock value over the next 3–8 years. Below is an investor-oriented guide that lays out why investment interest is increasing, which projects and sectors deserve attention, and how to build a resilient investment approach along this fast-changing corridor. Projects like Gaur Yamuna City and Eldeco Ballads of Bliss are situated on the Yamuna Expressway, the most developing area in Noida.

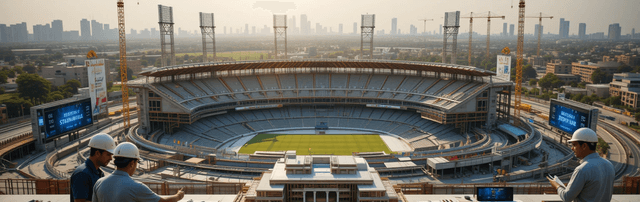

The most powerful single driver of investment interest on the Yamuna Expressway is the emergence of the Jewar (Noida International) Airport and the supporting industrial and logistics ecosystem being developed around it. The airport has already changed the investment calculus for land and ready inventory in nearby YEIDA sectors; planners and developers are projecting residential clusters, commercial hubs, and logistics parks to absorb many of the jobs and services that will spring up once the airport becomes fully operational. YEIDA’s master planning, which covers residential sectors, mixed-use parcels, and industrial land, provides a framework for phased—yet predictable—growth that investors can model into their returns. For investors this means that being positioned in sectors closest to the airport and feeder corridors—while still affordable—can deliver outsized appreciation as airport-linked employment centers and cargo operations scale.

Beyond the airport itself, YEIDA and state agencies are actively converting traditional villages and under-utilized agricultural tracts into higher-value land uses—everything from smart-village pilots to fully planned residential sectors. These public initiatives are not merely cosmetic; they include basic services such as all-weather roads, electrification, sewerage, and broadband connectivity that materially reduce execution risk for private developers and improve the livability of the area. For example, recent state announcements about smart village upgrades and YEIDA’s continued plot and township schemes underline a coordinated development push that will benefit nearby housing and commercial projects as physical infrastructure arrives and quality-of-life improvements follow.

Investment interest is also being fuelled by a surge in logistics and industrial land allocations along the corridor. YEIDA has recently allotted land for large logistics parks and warehouse facilities—projects that typically anchor employment growth, stimulate ancillary services, and create continuous rental demand for housing within a practical commute radius. Logistics hubs drive stable, long-term demand from blue-collar and white-collar workers and create a more diversified local economy versus purely residential expansion. Investors who buy plots or apartments near planned or allotted logistics zones can therefore capture a dual benefit: rental demand from workforce housing and capital gains from improved industrial connectivity.

On the demand side, developers have responded with a steady pipeline of new launches—ranging from plotted developments and affordable housing to township-grade gated communities and aspirational villas. Established brands and smaller local developers are launching projects in sectors such as 22A, 22D, 24A and beyond, with offerings that include plotted land, apartments, and integrated townships. Those launches appeal to different buyer profiles: end-users seeking bigger homes or better amenities at lower per-sqft costs, investors hunting for plot appreciation, and rental investors focused on ready-to-move inventory. Mapping the product type to your investment horizon is crucial: plots typically require a longer hold but can yield large gains if you buy genuinely early; ready-to-move apartments generate cash flow sooner but may provide more modest capital upside.

Which locations along the Yamuna Expressway deserve special attention? The most attractive micro-markets cluster around three catalysts: proximity to Jewar Airport, feeder road and expressway access, and designated YEIDA sectors where master plans and civic services are prioritized. Sectors that are being actively promoted for residential development—such as Sector 22D and Sector 24A—are already receiving developer focus and offer more predictable growth patterns because their land use is defined and serviced under YEIDA’s master plan. Similarly, plots and township projects near the F1 Buddh International Circuit and major township nodes (for example Gaur Yamuna City and other developer townships) offer diversified appeal because they combine leisure, retail, and connectivity elements that support long-term demand.

For investors who prefer tangible proof points, a handful of established and high-visibility projects provide useful comparators. Large township projects that have already completed phases create a rental ecosystem and show how amenities and connectivity influence occupancy and pricing. Meanwhile, brand-led launches by national developers provide the reassurance of delivery track records and structured payment plans—two important risk mitigants in a growth corridor. These completed and near-completed projects are also helpful for benchmarking per-sqft rates and forecasting appreciation scenarios for newer launches. Check developer credentials, RERA registration, and phase-wise completion records as a basic screening step before committing capital.

Timing matters in the Yamuna Expressway market. Many of the most compelling gains occur when infrastructure milestones—like airport operations, logistics park allotments or major road links—move from announced to under-execution stages. That’s why investors who want the upside often seek properties that are already technically serviced or are in sectors with visible public works underway. Conversely, buyers who prefer lower risk typically favor ready-to-move inventory in established townships where rental demand is already being realized. An intelligent strategy combines both: allocate a portion of capital to a ready asset that produces rental yield and a smaller portion to a well-placed plot or under-construction apartment that offers higher upside if the macro catalysts play out.

Risk management is essential. Land banking without a clear understanding of the master plan, access rights, and long-term public works timeline can leave buyers exposed to liquidity risk. Always verify YEIDA sanctions, RERA registrations, and title clearances. Where possible, view projects that have visible development activity rather than just paper plans. If you’re considering plots, assess the exact distance to confirmed airport access points and feeder roads—small differences in distance can translate into large valuation gaps as the airport and logistics facilities become operational. Also consider exit windows: the corridor often rewards a 5–8 year horizon for plot plays, while apartments in ready townships can be considered on a 3–5 year timeline depending on rental performance and broader market cycles.

From a practical investor playbook perspective, begin by narrowing your goals: do you want immediate rental yield, high mid-term appreciation, or a long-term land bet? For rental yield, prioritize ready projects inside established townships with amenities and proven occupancy. For mid-term appreciation, target under-construction apartments in sectors that are clearly linked to the airport’s feeder network and upcoming YEIDA services. For long-term gains, pick authorized YEIDA plots or early-phase township plots closest to confirmed logistics and industrial allocations. Layer in basic due diligence—RERA checks, delivery timelines, payment structures, and past delivery record of the developer—and ask for staged lock-in and escrow arrangements where available.

Finally, keep your portfolio diversified across product types and time horizons. The projects like Gaur Yamuna City and Eldeco Ballads of Bliss, Sector- 22D offer immense growth potential, making them ideal for both investment and modern living. The Yamuna Expressway corridor is uniquely positioned to deliver both steady rental markets and large capital gains—but patience and selection are the keys. Invest where public infrastructure is demonstrable, where developers have a clean track record, and where your holding period matches the expected infrastructure completion timeline. As YEIDA continues to issue plot schemes, allot land for logistics hubs, and upgrade village infrastructure, the expressway corridor will likely remain a primary destination for investors who want exposure to airport-driven, logistics-led, and township-style growth.

The residential Real Estate Buyer...Read more

Kalpataru Vista is a new premium...Read more

Change your lifestyle, change Your...Read more

Jewar Airport is an Noida International...Read more

Noida has become one of...Read more

Gurgaon‘s Golf Course...Read more

There will soon be a...Read more

Connecting the corners of the...Read more

It's that time of the...Read more

Metaverse real estate is one...Read more

Are you looking for ways...Read more

Budget 2023 - The projects...Read more

The process of buying and...Read more

The Delhi–Mumbai Expressway is a 1,386 km...Read more

The commercial real estate sector...Read more

The Uttar Pradesh cricket association...Read more

Nestled in the lush greenery...Read more

The...Read more

Introduction

Noida has rapidly become one...Read more

Noida’s real estate market has...Read more

Noida is no...Read more

The Read more

Noida...Read more

The allure of real estate...Read more

India's real estate sector is...Read more

Find your dream property with trust, quality, and the

perfect match for your needs.

Office Address

303, Tower 4, Assotech Business Cresterra,

Sector 135 Noida, Uttar Pradesh, India 201305

Contact

+91 9582-211-311

Email Us

info@propcasa.com